Building Financial Resilience

Saving money can be difficult, no doubt about it. According to a report from the Federal Reserve, 49% of American households have about 3 months of expenses in liquid savings, and only 39% have saved 6 months’ worth.

Life is full of surprises, so it’s important to have a healthy, easily accessible emergency fund so you can handle unexpected expenses or disruptions to your household income. Many financial planners recommend making this fund a priority over paying down debt or saving for retirement. Doing so helps to avoid high-cost borrowing when large, unexpected expenses arise.

If building an emergency savings fund is one of your goals for 2024, join thousands of others in stepping up your savings.

Omaha FCU promotes and believes in good savings behavior and discipline. No matter your financial situation or how much you earn, you can save. Even the smallest amounts tucked away regularly will accumulate into a nice savings cushion.

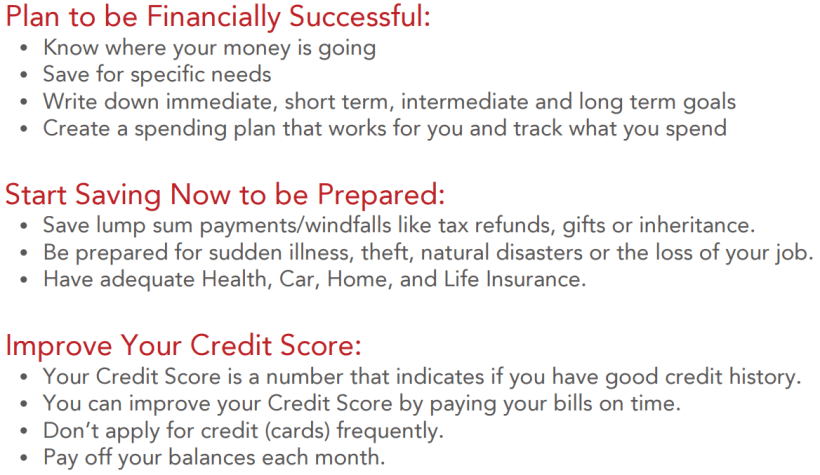

We encourage members to do a periodic financial check-in, set a savings goal, and make a plan to achieve it. Stay on course and remember to pay yourself first.

Omaha FCU is an advocate for saving and helping members achieve and maintain financial success.

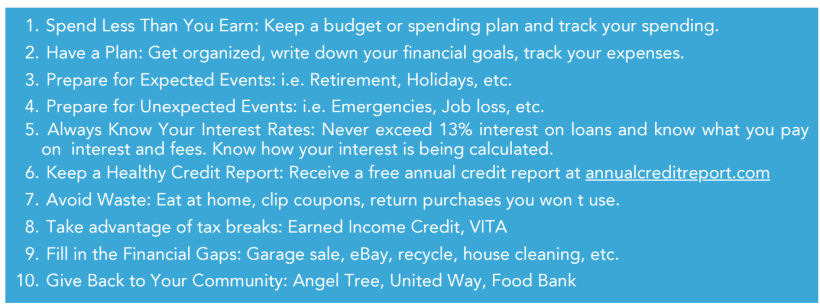

Here are a few tips to help you with your monetary savings goals: